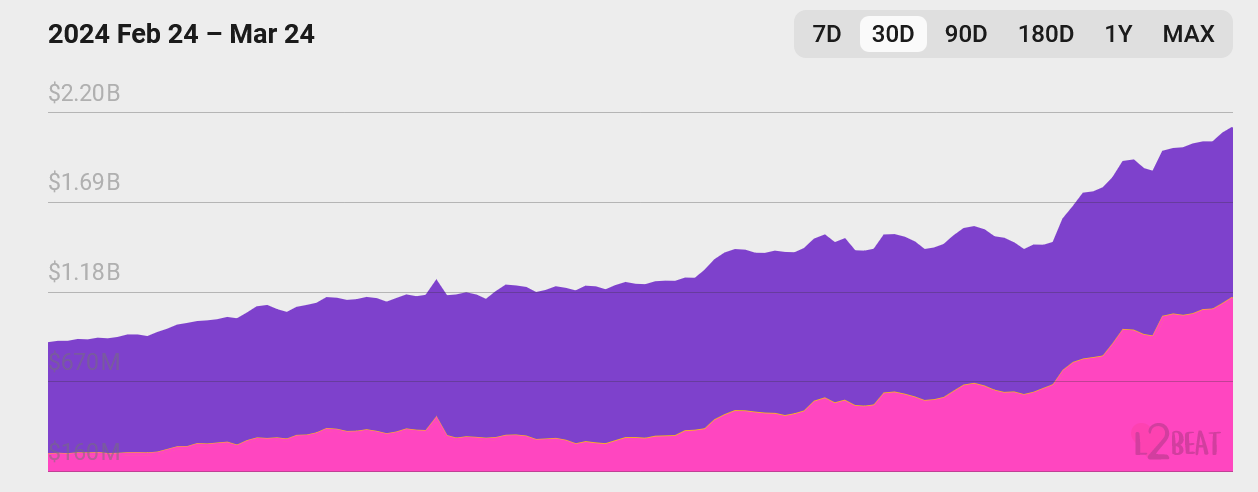

Base TVL doubles in a month as pundits tip memecoins to drive adoption

Futures Market Updates

Bitcoin Futures Updates

Ether Futures Updates

Top 3 OI Surges

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Faces Deadline for Grayscale XRP ETF Decision

Ethereum Bulls Remain Unfazed: Analyzing Market Confidence After $232 Million Liquidation

Ethereum’s price is fluctuating around $3,700, influenced by US credit and labor data, with traders cautiously avoiding high leverage. Whale activity indicates limited bearish sentiment, but there is insufficient confidence in a rapid rebound. No warning signals have been observed in the derivatives market, and a recovery will require clearer macroeconomic signals. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

BNY Mellon Empowers Crypto Ecosystem with Robust Infrastructure

In Brief BNY Mellon enhances its crypto ecosystem role through infrastructure services, not its own coin. The bank supports stablecoin projects instead of launching an altcoin amid positive market conditions. BNY Mellon prioritizes infrastructure over token issuance, promoting collaboration and ecosystem strength.