YEI Finance: A Complete Guide to the DeFi Protocol and CLO Price Prediction

If you’ve been exploring the latest trends in decentralized finance, you’ve probably come across yei finance—and for good reason. As we move toward the end of 2025, yei finance has stepped up as one of the most innovative and user-friendly lending platforms around. Combining the speed of Sei blockchain with the flexibility of the Clovis ecosystem, it’s catching the attention of crypto enthusiasts, yield hunters, and developers alike. Let’s dive deeper into what yei finance is, how it works, why it matters, and where its token CLO price might be heading next.

What Is YEI Finance?

Yei Finance is a decentralized, non-custodial protocol designed for money markets in the new era of DeFi. By deploying its markets on the Sei blockchain, Yei Finance capitalizes on high throughput and ultra-fast confirmation times, empowering users to deposit assets, earn attractive yields, and borrow against their holdings with ease. The protocol not only prioritizes transparency and security through rigorous smart contract auditing, but it also embraces a modular architecture thanks to its integration with the Clovis Network. This synergy allows Yei Finance to serve as both a robust standalone platform and a critical building block within a growing ecosystem of decentralized financial products, positioning itself as a futureproof solution in the rapidly evolving DeFi landscape.

How YEI Finance Works

The inner workings of Yei Finance are both advanced and user-centric. At its core, the protocol allows users to supply supported digital assets into dynamic liquidity pools. Once deposited, these assets accrue interest automatically, creating a passive income stream for liquidity providers. This earned yield is a direct function of the platform’s dynamic interest rate model, which adjusts based on the balance of supply and demand across the lending pools. For those seeking liquidity, Yei Finance offers over-collateralized borrowing: users can provide their assets as collateral and take out loans in various cryptocurrencies, optimizing capital efficiency without relinquishing ownership.

What sets Yei Finance apart is its sophisticated risk management. Riskier or particularly volatile assets are placed into isolated pools, ensuring that any adverse price action or liquidation event remains contained and does not cascade across the entire platform. Beyond this, the protocol is architected for multi-chain compatibility, meaning it is poised to enable seamless lending and borrowing across other leading ecosystems as its integration with the Clovis Network deepens. By focusing on both user safety and multi-chain operability, Yei Finance crafts a DeFi experience that is at once powerful and intuitive.

YEI Finance Features and Benefits

One of the most powerful aspects of Yei Finance is its multi-layered risk management system. Through real-time monitoring, automated liquidation mechanisms, and carefully selected price oracles, the platform safeguards both lenders and borrowers against market volatility and technical failures. The risk controls operate in tandem with Yei Finance’s dynamic interest rate system, where returns for liquidity providers and borrowing costs for users remain competitive, adjusting fluidly as the protocol’s utilization metrics fluctuate. This means yields are never stagnant, rewarding active participation and supplying liquidity where it's most needed.

Another significant benefit of Yei Finance is its seamless cross-chain integration potential. By aligning with the Clovis middleware, Yei Finance extends its reach beyond the Sei blockchain, preparing to bridge liquidity to other networks like Cosmos and Ethereum. This modularity is not just a backend feature; it’s a forward-looking guarantee of resilience and adaptability as DeFi continues to fragment and migrate between chains. Yei Finance also centers its community through strong governance mechanisms, allowing YEI token holders to vote on all major decisions, influencing both the future of the protocol and the assets it supports. All of this is wrapped in an interface that emphasizes clarity, speed, and ease, making DeFi accessible without sacrificing sophistication.

How To Get Started with YEI Finance

Engaging with Yei Finance begins with accessing its web platform and connecting a compatible cryptocurrency wallet. The protocol supports popular options such as MetaMask and Sei Wallet, ensuring that the onboarding process is smooth for most DeFi enthusiasts. Once connected, users can effortlessly deposit supported cryptocurrencies into Yei Finance’s liquidity pools and immediately begin earning interest. The borrowing process is equally streamlined: users select the assets they wish to use as collateral, determine their borrowing needs, and manage their loan-to-value ratios via an intuitive on-screen dashboard. For those interested in protocol governance, acquiring and staking the YEI token grants access to voting rights, enabling active participation in shaping upgrades, fee models, and future asset integrations. As cross-chain compatibility becomes a reality, users of Yei Finance will also be able to bridge assets to and from other blockchains, unlocking further earning or arbitrage opportunities—all without leaving the platform’s sleek, secure environment.

YEI Finance Tokenomics

The YEI token is the economic engine of YEI Finance, designed with strong DeFi fundamentals:

-

Governance: Vote on critical protocol upgrades and roadmap adjustments.

-

Staking: Lock YEI to receive a share of platform revenue and additional incentives.

-

Deflationary Mechanics: Part of each transaction fee is used to buy back and burn YEI, supporting long-term value.

-

Liquidity Mining: Early adopters and liquidity providers are rewarded with YEI emissions, bootstrapping TVL and platform liquidity.

Token Allocation (Approximate, based on docs):

-

Community/Ecosystem: 35%

-

Yield Mining: 30%

-

Team/Advisors: 15%

-

Treasury: 10%

-

Public Sale: 10%

YEI Finance aligns its incentives with usage, platform revenue, and governance, setting the stage for sustainable growth.

YEI Finance Roadmap and Clovis Ecosystem Integration

YEI Finance’s development trajectory is ambitious, with several upcoming milestones:

-

Q2 2024: Mainnet launch on Sei, onboarding of primary assets and stablecoins.

-

Q3 2024: Expanded asset listings, isolated risk pool deployment, and oracle upgrades.

-

Q4 2024: Launch of cross-chain lending/borrowing with Cosmos and EVM integrations.

-

2025: Third-party integrations via Clovis modules, institutional vaults, advanced leverage products, and insurance rails.

By leveraging the Clovis network’s underlying technology, YEI Finance is one of the first protocols to offer modular money markets—making DeFi more composable and secure.

Benefits of Using YEI Finance

Choosing Yei Finance as your primary DeFi platform opens a suite of compelling advantages. The protocol’s interest rates are constantly optimized, ensuring that users receive competitive yields based on real-time liquidity demands. Security is paramount, with contracts fully audited, regularly tested, and supported by robust, automated liquidation processes that shield both lenders and borrowers from erratic market events.

Perhaps most distinctively, Yei Finance is built for a modular, cross-chain world. By tapping into the reach of both the Sei blockchain and Clovis middleware, users are empowered to transfer assets and access new earning opportunities beyond the limitations of a single network. Participation in governance offers users the ability to steer the future of the protocol, ensuring it remains responsive and community-driven. All of these benefits are delivered in an environment designed for accessibility, allowing both advanced users and DeFi newcomers to participate with confidence.

Risks and Considerations

Like all decentralized finance protocols, engagement with Yei Finance is not without risks. Despite rigorous code audits and continuous real-time monitoring, smart contract vulnerabilities, though minimized, cannot be completely ruled out. Rapid and unexpected market movements can cause collateral values to plunge, potentially triggering liquidations and cascading effects within isolated pools. Since Yei Finance relies on complex oracle systems for real-time asset pricing, any manipulation or failure of these feeds could also compromise user safety.

Liquidity, especially in more experimental or exotic isolated pools, may sometimes be limited, which can affect a user’s ability to exit positions or secure attractive loan terms during market turbulence. While Yei Finance incorporates state-of-the-art risk management, provides clear user guidance, and transparently displays all system metrics, prospective users should undertake their own due diligence and consider a diversified approach to crypto investing and DeFi participation.

YEI Finance vs. Other Lending Protocols

Yei Finance distinguishes itself from established protocols like Aave, Compound, or Kava through its unique deployment on the Sei blockchain and its foundational partnership with Clovis. This technical alignment bestows Yei Finance with paramount transaction speed, exceptionally low fees, and immediate composability across multiple blockchains as the modular Clovis network matures. Unlike more monolithic DeFi money markets, Yei Finance is built to support isolated risk pools and modular upgrades—allowing for tailored risk exposure that larger platforms, still reliant on pooled-risk architectures, do not always provide.

Governance is another area where Yei Finance excels. Through the YEI token, users are directly involved in the protocol’s evolution, driving listing decisions, adjusting risk parameters, and shaping fee structures in a manner that is fully transparent and community-first. As cross-chain innovation accelerates throughout 2024 and beyond, Yei Finance’s seamless architecture and expansion-ready design firmly establish it as a protocol tailored for the future.

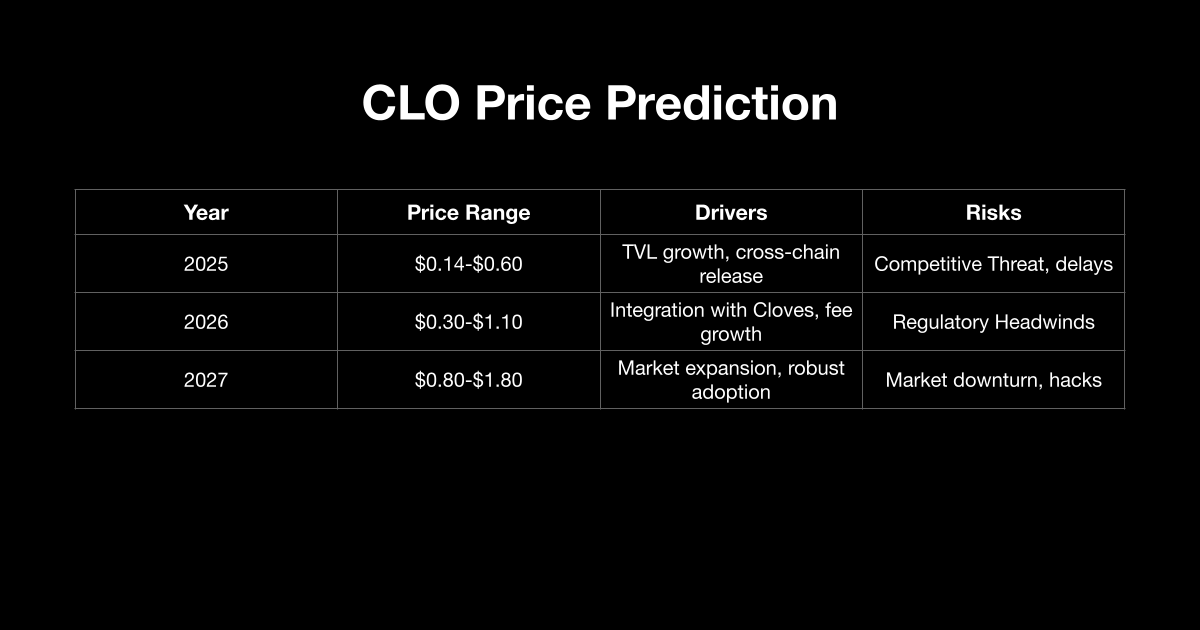

YEI Finance Token Price Prediction 2025, 2026, 2027

A common question is: What is the potential price path for the YEI Finance token over the next few years? While all predictions are speculative, examining the fundamentals, technical roadmap, ecosystem integration, and comparative DeFi token performance provides a reasonable framework.

Factors Driving YEI Finance Price:

-

Platform TVL Growth: More deposits and loans drive yield, rewards, and buyback pressure.

-

Cross-chain Expansion: Integration with new chains attracts more users and assets.

-

Fixed Supply & Burning: Deflationary mechanics support potential upward price pressure over time.

-

Ecosystem Partnerships: Clovis, Sei, and third-party DeFi protocols could unlock new demand for YEI Finance.

-

Wider Exchange Listings: Binance, Bitget, and other major CEX/DEX listings may boost liquidity and price discovery.

Price Prediction Table

Conclusion: The Future of YEI Finance

In summary, Yei Finance stands out as a DeFi protocol built for the demands of the modern crypto world: high speed, strong security, flexible architecture, and seamless cross-chain interaction. Its unique partnership with the Clovis network, robust governance via the YEI token, and relentless focus on risk management make Yei Finance a top contender for both yield seekers and DeFi innovators. As the protocol continues to expand its technical footprint, improve user incentives, and deepen integration with leading blockchains, both users and developers have compelling reasons to watch—and actively participate in—the Yei Finance ecosystem.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.