Bitcoin falls back to 98,000, is a year-end rally out of the question?

The U.S. government shutdown has officially come to an end, but the capital markets did not see a rebound.

During Thursday's U.S. trading session, all three major U.S. stock indices fell sharply, with the Nasdaq dropping more than 2% and the S&P 500 closing down 1.3%; gold lost a key support level;

Bitcoin suffered an even steeper plunge, dropping to as low as $98,244 by the close of the U.S. stock market, marking its lowest point since early May. This is also the third time this month that Bitcoin has fallen below the $100,000 mark.

Market sentiment has slid from its highs, returning to the "extreme fear" zone.

This long-awaited "government restart" has not alleviated the market's structural pressures:

Liquidity tightening, concentrated selling by long-term holders, continued ETF outflows, and rapidly cooling rate cut expectations.

The U.S. Session Becomes Bitcoin's "Main Selling Force": Risk Appetite Plummets + Liquidity Tightening Resonates

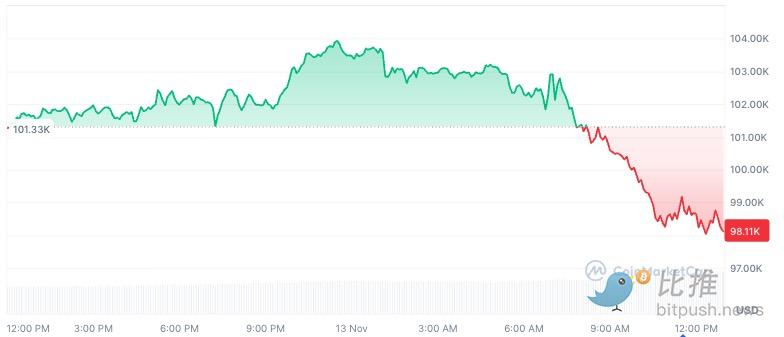

Bitcoin once rebounded to near $104,000 during the Asian session, but quickly weakened after entering the U.S. trading hours, plunging below $100,000 in the afternoon and hitting a low of $98,000.

This trend closely mirrored the simultaneous decline in U.S. tech stocks:

-

Nasdaq plunged

-

Crypto-related stocks such as Coinbase and Robinhood fell

-

Mining stocks led the decline, with Bitdeer plummeting 19%, Bitfarms down 13%, and several mining companies dropping more than 10%

The fundamental reason is:

Rate cut expectations cooled rapidly → risk assets were broadly sold off.

Last week, the market believed there was an 85% chance of a rate cut in December;

now, FedWatch shows only 66.9%.

The prospect of "cheap money" in the future is no longer certain, making it difficult to support Bitcoin's valuation.

Meanwhile, U.S. fiscal policy is also draining liquidity.

During the government shutdown, the federal government recorded a surplus of about $1.98 billion, and due to the large-scale shutdown, the October surplus could be even higher. This means the government has temporarily reduced its "blood transfusion" to the market.

Analyst Mel Mattison described it as:

"This is the driest fiscal liquidity environment in months, if not years."

With fiscal tightening and monetary cooling, the U.S. session has become the dominant force in Bitcoin's recent plunge.

However, Mattison also pointed out that fiscal tightening is only a short-term phenomenon:

"The fiscal floodgates are about to reopen, and the Trump administration must ramp up stimulus before the midterm elections."

On-chain Selling Pressure Concentrated: LTH Profit-taking Combined with Whale Sell-offs, Forming Resonant Downward Movement

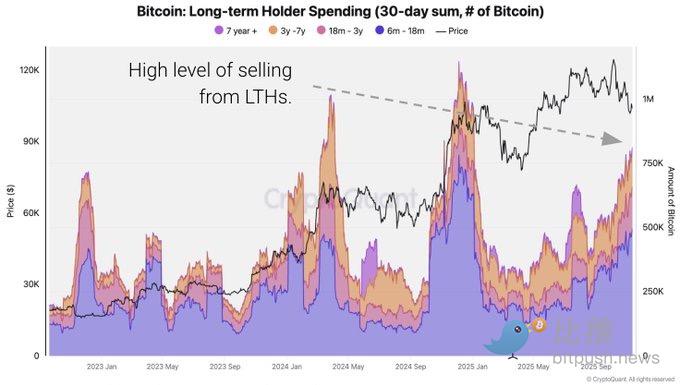

This round of Bitcoin falling below $100,000 was not caused by retail panic, but is a typical structural adjustment of simultaneous position reduction by mid- to long-term on-chain capital.

CryptoQuant data shows that long-term holders (LTH) have sold a total of about 815,000 BTC in the past 30 days, marking the highest selling volume since January 2024. On November 7, there was about $3 billion in on-chain Bitcoin profit-taking sales, indicating that a large amount of low-cost coins chose to cash out at this price level. Similar profit-taking pressure occurred during the mid-stages of the 2020 and 2021 bull markets, often corresponding to a phase of adjustment.

Meanwhile, whale activity has increased significantly, accelerating the downward pressure.

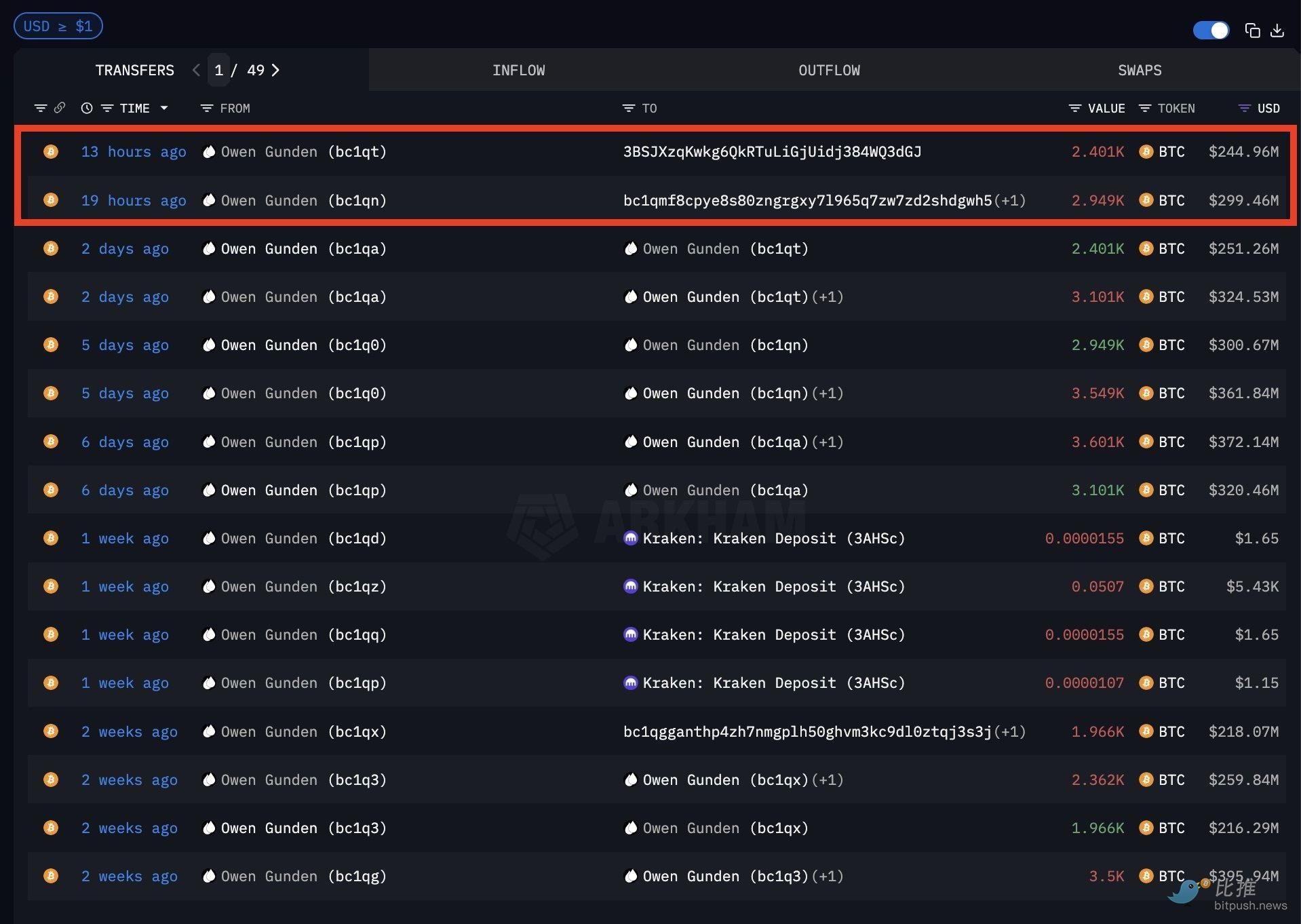

Arkham tracked:

-

Early BTC whale Owen Gunden sold about $290 million in BTC in a single day and still holds $250 million in assets;

-

A Satoshi-era whale who held coins for nearly 15 years liquidated about $1.5 billion last week;

-

In October, large address 195DJ cumulatively sold 13,004 BTC and continued to transfer coins to exchanges.

This means:

LTH profit-taking + concentrated whale movement of coins → extremely strong selling pressure in the short term.

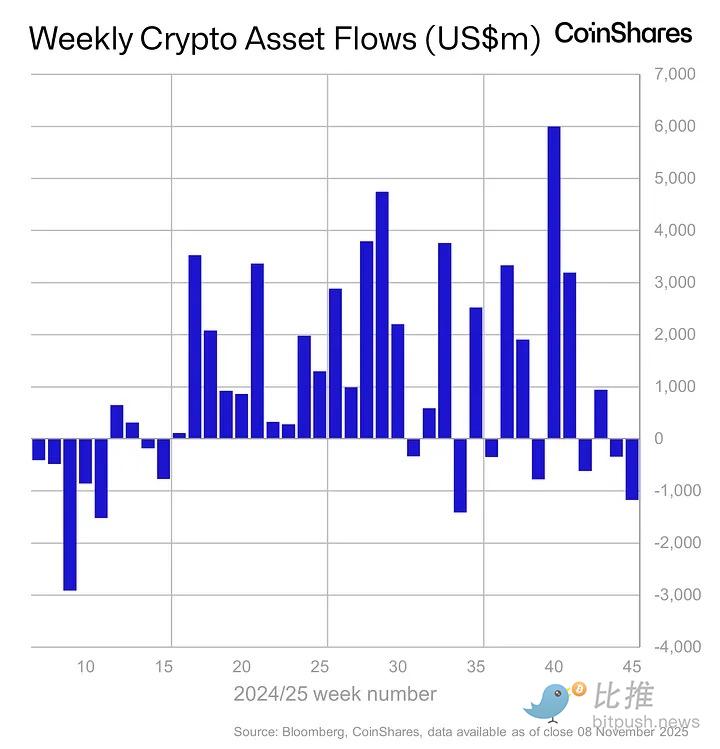

ETF/ETP Funds Continue to Flow Out, U.S. Market Under Greatest Pressure

According to a CoinShares report, global digital asset investment products have seen large outflows for the second consecutive week, with net outflows reaching $1.17 billion last week. Most of the capital flight occurred in the U.S. market, with outflows as high as $1.22 billion, while the European market (Germany, Switzerland) still recorded about $90 million in net inflows, showing a clear divergence.

Among them, Bitcoin and Ethereum were the "main battlegrounds" for this round of withdrawals:

-

Bitcoin products saw net outflows of $932 million

-

Ethereum products saw net outflows of $438 million

-

During the same period, short Bitcoin products recorded net inflows of $11.8 million, the highest level since May 2025

ETFs provided strong upward momentum for Bitcoin in 2025, but when this buying power stalls and turns to outflows, prices naturally come under pressure.

Can New Highs Still Be Reached This Year?

Bitcoin is currently hovering below the 365-day moving average. CryptoQuant regards this as an important trend support level for this bull market: once it stands back above the average, the market may regain strength; if it continues to be under pressure, a mid-term correction similar to September 2021 may occur.

The Fear and Greed Index has dropped to 15 (extreme fear), which is highly similar to previous "deep shakeouts in the middle of bull markets."

From the combined signals of macro, on-chain, ETF, and technical structure, the likelihood of breaking through a new high of $126,000 this year has significantly decreased.

Before the end of the year, Bitcoin is more likely to fluctuate between $95,000 and $110,000.

To break out strongly, three major conditions must be met:

-

ETF resumes sustained net inflows

-

U.S. fiscal stimulus is clearly implemented

-

U.S. Treasury yields fall and dollar liquidity improves

But judging from the policy pace, these three are more likely to occur at the beginning of 2026 rather than by the end of 2025.

Looking Ahead to 2026: Liquidity and Cycle May Resonate

Despite short-term pressure, Bitcoin's medium- to long-term trend remains solid.

2026 may even become the core year of this cycle.

① Macro liquidity is expected to truly reverse

As the economy slows and employment weakens, the probability of the Federal Reserve entering a substantive rate cut cycle in 2026–2027 increases.

② ETF institutional expansion will bring larger-scale buying

In 2025, ETFs have already validated the power of institutional buying.

Against the backdrop of a rate cut cycle, pension funds, global asset managers, and RIAs—so-called "long-term money"—will enter deeply through ETFs, reshaping the valuation system.

③ 2026 is the "second year after the halving": historically the strongest window

2013, 2017, 2021

All three cycles saw new, larger highs in the "second year after the halving."

Based on this, our range estimate for 2026 is:

-

Base target: $160,000 – $240,000

-

Bullish scenario: $260,000 – $320,000

This round of decline looks more like a deep shakeout in the middle of a bull market, rather than a trend reversal.

What will truly determine Bitcoin's next peak will be the resonance of macro and institutional capital in 2026.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aztec launches public fundraising—are there still buyers after a 7-year wait?

A quick overview of the auction details and tokenomics.

Gold Rush Handbook: Why Are Top VC Benchmarks Focusing on Fomo?

Benchmark, which has previously invested in Uber, X, and Instagram, is making another move: betting on the minimalist social crypto trading app fomo.

What is Seismic, the privacy blockchain that a16z has led two consecutive funding rounds for?

As cryptocurrencies move toward mainstream adoption, the demand for privacy protection is becoming more urgent than ever.