3 Altcoins Facing Major Liquidation Risk in the Second Week of November

XRP, Zcash, and Starknet are showing strong momentum but carry high liquidation risks for leveraged traders this week. Analysts warn that overleveraged longs could face steep losses if market sentiment turns.

While the altcoin season has yet to return, a few altcoins are showing stronger performance than the rest of the market in the second week of November. However, these same tokens also face the risk of triggering massive liquidations for short-term traders.

Which altcoins are they, and what risks are involved in trading their derivatives?

1. XRP

Short-term trader sentiment for XRP remains highly optimistic as Canary Capital prepares to launch its Spot XRP ETF on November 13.

Additionally, five XRP spot ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list. This development strengthens investor confidence that multiple XRP ETFs could soon receive approval.

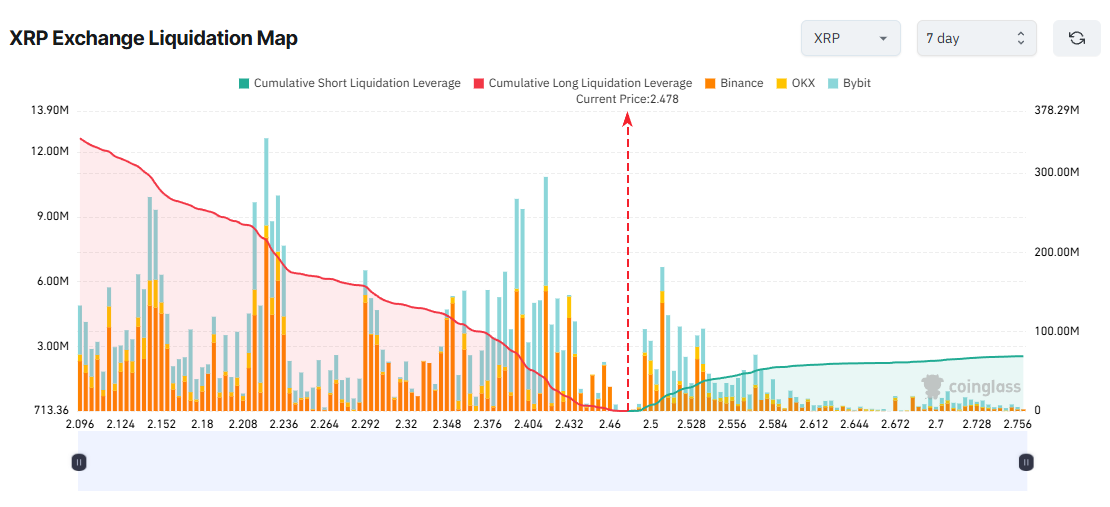

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

The 7-day liquidation map indicates a significant concentration of potential long liquidations, suggesting that many traders are anticipating an XRP price rally this week.

However, BeInCrypto’s latest analysis reveals a sharp decline in new XRP addresses over the past week, indicating a weakening of interest from new investors. Moreover, the MVRV Long/Short Difference has dropped, increasing the likelihood of a price correction.

If XRP falls toward $2.10 this week, long positions could face more than $340 million in liquidations. Conversely, if XRP rises to $2.75, short positions may be liquidated for around $69 million.

2. Zcash (ZEC)

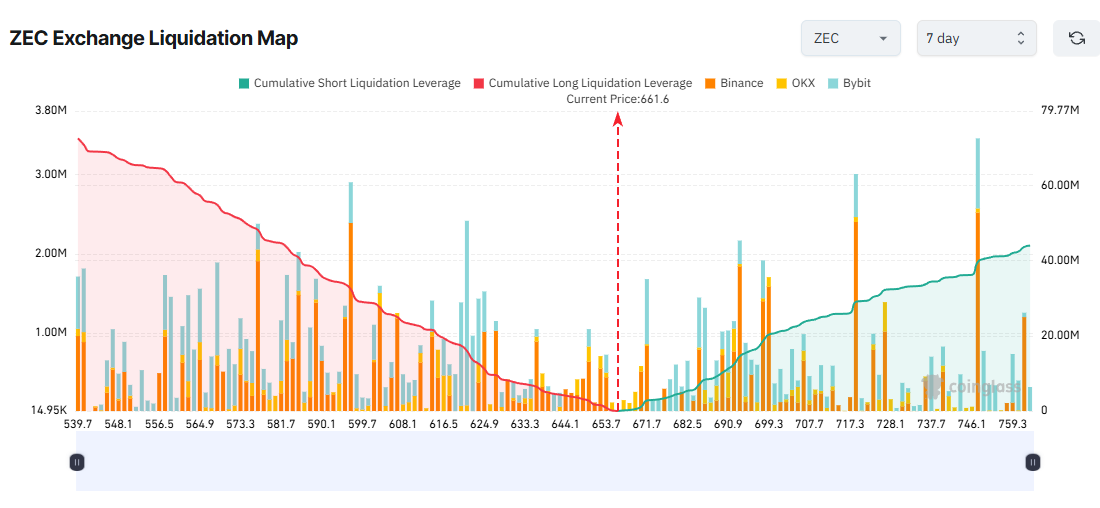

The rally in Zcash (ZEC) shows no sign of slowing down in the second week of November. Although ZEC reached $750 before correcting to around $658, many traders still expect the price to climb toward $1,000.

The 7-day liquidation map reveals that short-term derivatives traders are allocating more capital and leverage toward long positions. This means they could face larger losses if ZEC experiences a correction this week.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC drops to $540, over $72 million in long positions could be liquidated. Conversely, if ZEC surges to $760, roughly $44 million in shorts could be wiped out.

Analysts warn that ZEC may be forming a classic parabolic uptrend after a 10x rally, possibly nearing the final stage of the pattern.

“Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO imo,” investor Gunn said.

3. Starknet (STRK)

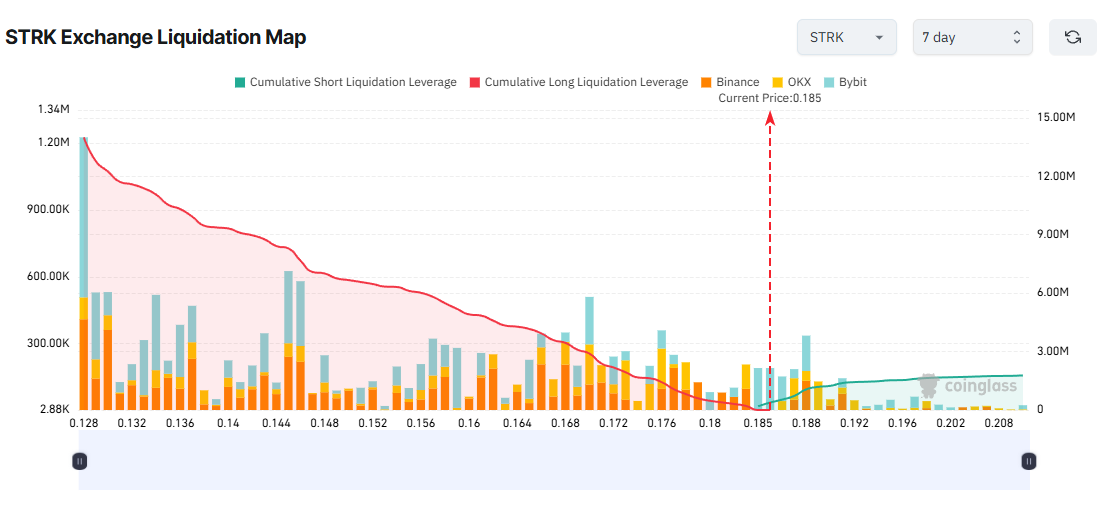

Starknet (STRK) surprised the market in the second week of November with a 30% daily surge, recovering losses from last month’s sharp decline.

Several analysts suggest STRK may be breaking out of a long-term resistance line, potentially kicking off a strong new bull run.

Liquidation map data reflects this short-term bullish sentiment, showing a dominance of potential long liquidations over shorts.

STRK Exchange Liquidation Map. Source:

Coinglass

STRK Exchange Liquidation Map. Source:

Coinglass

However, CryptoRank reports that STRK is among the top 7 altcoins with major token unlocks this week. More than 127 million STRK tokens will be unlocked, potentially adding significant selling pressure and disrupting the plans of leveraged long traders.

If STRK falls to $0.128, approximately $14 million in long positions could be liquidated. Conversely, if it breaks above $0.20, about $1.78 million in shorts could be wiped out.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Altcoin ETFs Move Closer to U.S. Approval After DTCC Surpasses Major Obstacle

- DTCC's approval of Bitwise's CLNK ETF marks a key step toward U.S. altcoin ETFs, with XRP-focused funds from 5 firms now listed. - XRP ETFs like Canary's XRPC and Grayscale's proposed offering highlight growing institutional demand for crypto exposure. - SEC resumes reviews post-government shutdown, accelerating approvals for pending applications including XRP Trust conversion. - Historical ETF inflows and CME's crypto derivatives success suggest regulatory clarity could drive significant capital into al

Bitcoin News Today: Whale Faces $190M Short Liquidation Risk as Bitcoin Approaches $104K

- Bitcoin nears $104K as a whale's $190M short position risks liquidation, potentially boosting prices to $105K. - Market volatility grows from $240M institutional selling and leveraged trading risks highlighted by Arkham Intelligence. - CME Group expands crypto products (XRP futures) amid regulatory scrutiny and record October trading volumes. - Whale liquidation could trigger cascading effects, testing Fibonacci resistance and accelerating BTC's bullish momentum. - CME's $7.3B 2028 revenue forecast contr

ZEC rises by 5.95% as whales reduce holdings and accumulation becomes evident

- ZEC surged 5.95% in 24 hours amid whale liquidation reducing its stake from $37M to $10.37M, triggering $960K realized losses. - Binance saw $33M ZEC accumulation via 2,200 coins/second trades, suggesting coordinated large-scale buying. - Grayscale’s Zcash Trust hit $151.6M AUM, reflecting institutional interest in ZEC’s hybrid privacy model aligned with U.S. regulatory clarity. - Whale position reversals and accumulation signals highlight ongoing bear-bull dynamics, with technical indicators like RSI di

DASH rises by 6.6% as quarterly results and recent strategic actions fuel near-term positive sentiment

- DASH surged 6.6% in 24 hours ahead of its Nov 12 earnings report, driven by strategic investments in autonomous delivery and a $5.1B acquisition. - The company’s 35.22% monthly gain and 88.68% annual rise reflect expanded partnerships with McDonald’s , Waymo, and Kroger , boosting order growth and market reach. - Analysts remain cautious due to high valuation risks and competition from Uber Eats and Instacart, despite DoorDash’s aggressive expansion into AI-driven commerce.