XRP Could Unlock $1.5 Trillion in Liquidity for US, Proposal Claims

The document advocates classifying XRP as a payment asset rather than a security, urging regulatory changes and a presidential executive order to accelerate adoption.

A proposal suggesting XRP as a strategic financial asset has been submitted to the US Securities and Exchange Commission (SEC). The SEC often receives unsolicited proposals from individuals or entities, but these do not automatically lead to action.

The document outlines how the US could use XRP to unlock liquidity and potentially secure a substantial Bitcoin reserve.

XRP Suggested as Key Liquidity Tool For the US Crypto Reserve

The proposal’s author, Maximilian Staudinger, advocates for a structured approach to President Donald Trump’s crypto reserve initiative. Staudinger’s strategy places Bitcoin at the core of the US reserve while positioning Solana and Cardano within government applications.

He contends that while these blockchains enhance security and efficiency in state operations, XRP remains the key asset for financial transactions.

“Solana and Cardano should be integrated into US digital infrastructure, but not included in the reserve strategy. Instead, they enhance efficiency and security for state applications, while XRP remains the key asset for financial transactions,” Staudinger argued.

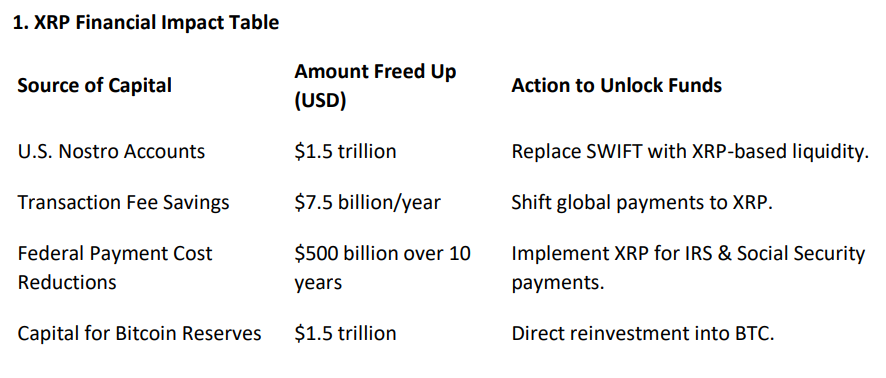

Considering this, Staudinger asserts that integrating XRP into the traditional financial system would release capital tied up in Nostro accounts. These accounts facilitate cross-border transactions and collectively hold $27 trillion worldwide.

He estimates that $5 trillion belongs to the US, with XRP potentially freeing up $1.5 trillion. This liquidity, he claims, could be redirected toward acquiring Bitcoin.

XRP’s Financial Impact as a Strategic Reserve Asset. Source:

Staudinger’s SEC Proposal

XRP’s Financial Impact as a Strategic Reserve Asset. Source:

Staudinger’s SEC Proposal

However, his suggestion that the US could secure 25 million BTC at a price of $60,000 per coin contradicts Bitcoin’s fixed 21 million supply cap.

Beyond liquidity, the proposal claims that shifting financial transactions to XRP could generate up to $7.5 billion in annual savings on transaction fees. It also suggests that XRP could streamline government payments, including IRS tax refunds and Social Security distributions

XRP’s Regulatory Uncertainty Poses Challenge

Despite its ambitious vision, the proposal acknowledges that XRP’s regulatory status remains a critical barrier.

Staudinger calls for the SEC to officially classify XRP as a payment asset rather than a security and urges a resolution in the agency’s ongoing legal battle with Ripple.

He also suggests that the Department of Justice (DOJ) lift restrictions preventing banks from utilizing XRP-based solutions. To fast-track adoption, he proposes a presidential executive order to override regulatory barriers.

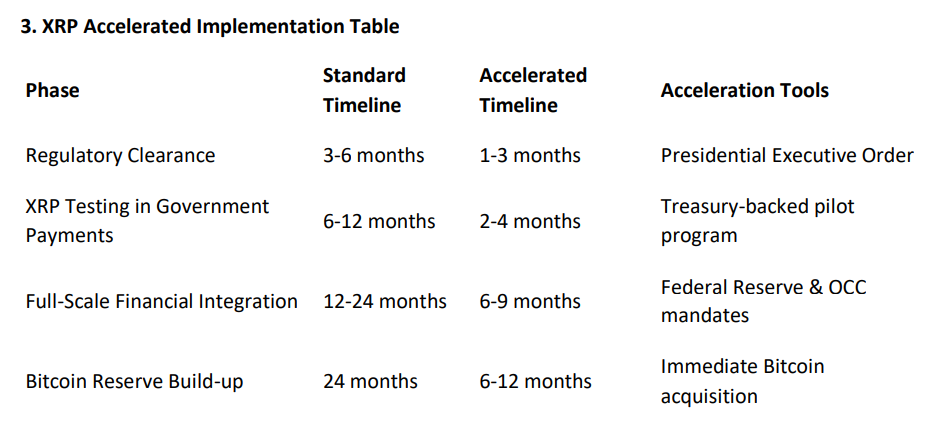

XRP’s Strategic Reserve Asset Implementation Timeline. Source:

Staudinger’s SEC Proposal

XRP’s Strategic Reserve Asset Implementation Timeline. Source:

Staudinger’s SEC Proposal

Meanwhile, the document outlines two potential timelines: a standard two-year implementation period and an expedited six- to twelve-month plan.

The latter would require immediate regulatory approvals, fast-tracked government XRP trials, and mandates for banks to integrate XRP as a liquidity tool.

It’s important to note that independent proposals, like Staudinger’s, generally have little weight unless backed by strong industry support or policy interest.

If a proposal comes from a major financial institution, regulatory body, or industry group, it is more likely to be reviewed seriously.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.