-

POPCAT has seen a significant 48% decline since February 2024, struggling to recover amid dwindling investor interest and limited market inflows.

-

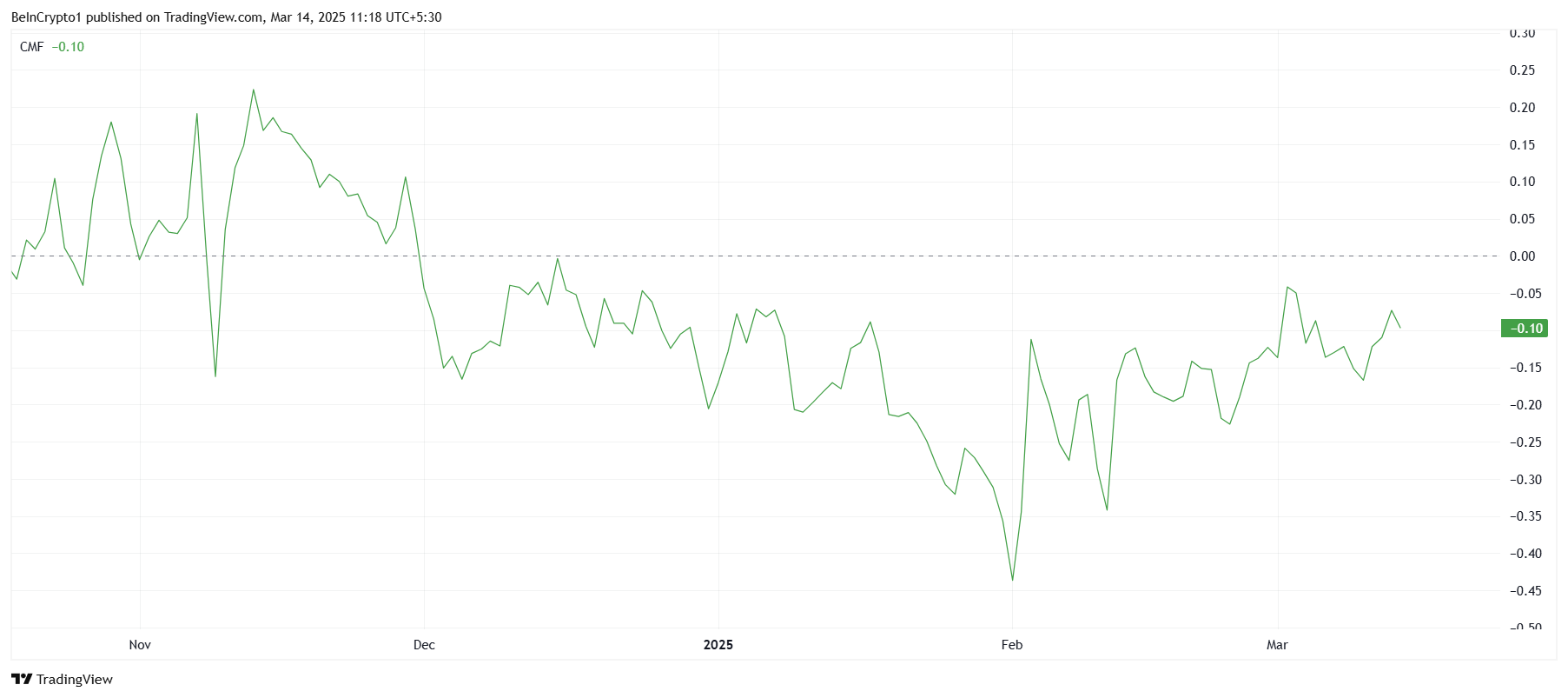

The latest indicators suggest persistent weakness in buying momentum, with the Chaikin Money Flow (CMF) remaining in negative territory.

-

“Breaking $0.203 could mark a critical turnaround for POPCAT, shifting market sentiment and potentially paving the way for a rebound,” analysts indicate.

An in-depth analysis of POPCAT’s recent struggles reveals a 48% price drop, weak investor sentiment, and potential resistance at key price levels.

POPCAT Faces Uphill Battle for Recovery

After dropping 48% since February, POPCAT is grappling with a challenging recovery landscape. Attempts to rally have been stifled by a lack of investor confidence, reflected in diminishing market volumes and weak buying pressure. The meme coin’s performance is further hindered by a notable lack of support from key technical indicators.

The CMF indicator, which assesses the flow of money into and out of an asset, has consistently remained below the zero line for over three months. This stagnation demonstrates a persistent fear among investors, halting any momentum that could have catalyzed a rebound. As a result, POPCAT’s price actions have been largely inconclusive, trailing beneath crucial psychological levels.

POPCAT CMF. Source: TradingView

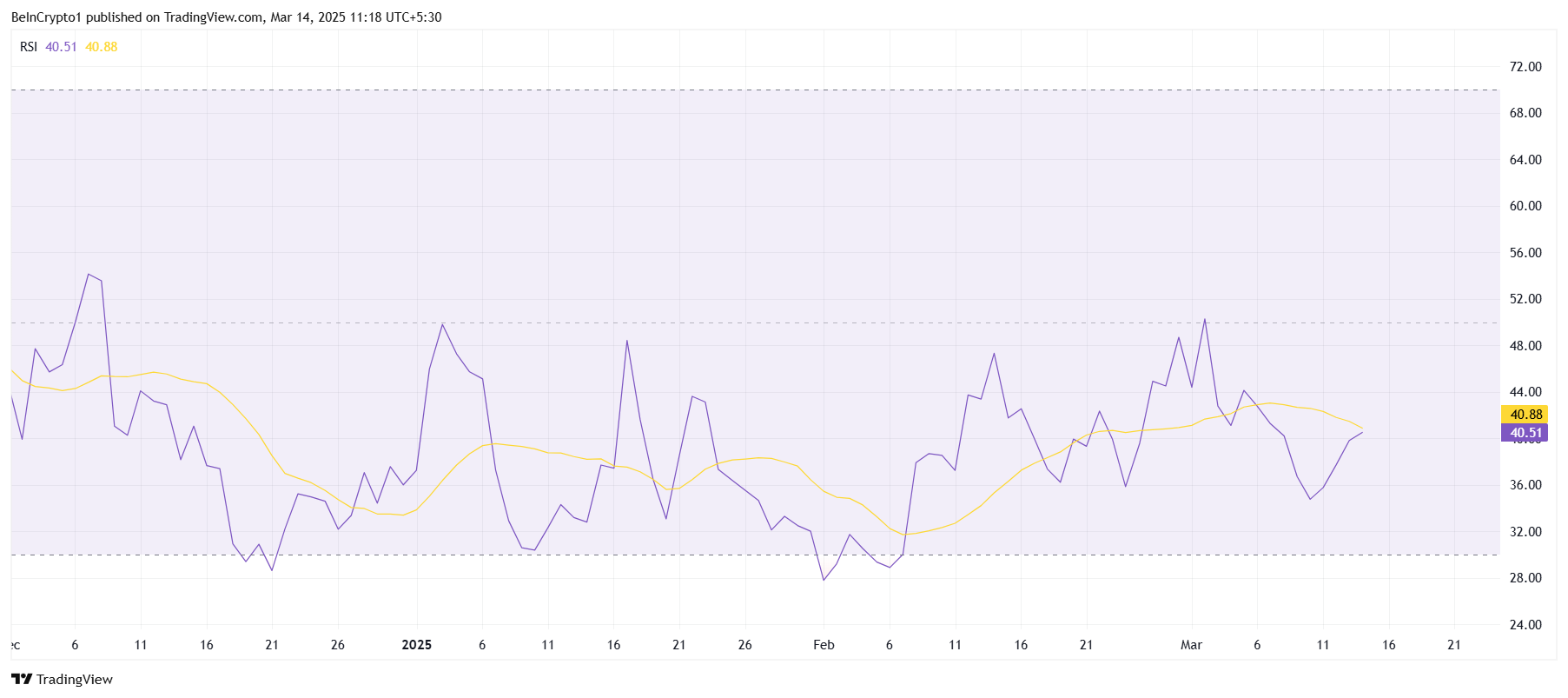

Furthermore, the Relative Strength Index (RSI) remains entrenched below the pivotal 50.0 threshold, suggesting that bullish signals are virtually non-existent at this juncture. Such indicators underscore significant challenges faced by POPCAT in overcoming its current downward trajectory.

Market Sentiment Holds Key to POPCAT’s Future

The overall market sentiment plays an essential role in POPCAT’s positioning. Without a supportive environment fostered by external market conditions, POPCAT’s price actions are likely to reflect stagnation, maintaining its bearish cycle. Investor apathy continues to dominate, compounded by a lack of substantial inflow to the altcoin.

For POPCAT to gain traction and potentially thrive, a shift in overall market conditions is necessary. Indicators signal that until broad investor confidence is restored, its journey towards recovery remains shaky at best.

POPCAT RSI. Source: TradingView

Consolidation Phase as Investors Await Market Movements

POPCAT’s recent fluctuations have led to a price consolidation, currently sitting at approximately $0.180 after a 20% uptick. The recent listing on Robinhood has sparked interest, potentially enhancing exposure and bringing new investors into the fold.

Despite this slight resurgence, the coin struggles against a resistance level of $0.203, established firmly over recent days. This ceiling is a considerable obstacle, especially amid prevailing doubts in broader market conditions. With ongoing hesitation from investors, projections suggest POPCAT will likely oscillate between $0.140 and $0.203 until more favorable conditions emerge.

POPCAT Price Analysis. Source: TradingView

If sentiment turns in favor of the altcoin, overcoming the $0.203 resistance could result in a bullish scenario, potentially allowing POPCAT to test the next resistance around $0.238. Such a breakthrough would not only validate the reversal but could also establish a more robust recovery pattern.

Conclusion

In summary, POPCAT remains in a precarious position, battling against negative investor sentiment and technical indicators. The next few weeks will be crucial in determining whether it can breach the $0.203 resistance, which could signal a shift in market dynamics. Investors are advised to monitor key indicators and seek timely insights as the altcoin navigates its path forward.