The current crypto market is going through a phase of consolidation after experiencing a rise from October to March, mainly benefiting investors who hold Bitcoin (BTC) and Ethereum (ETH). However, crypto holders are facing a harsh correction similar to a bear market, which is especially noticeable in discussions on social media within the crypto community.

Also Read: Bitcoin price falls amid US stock market rally, down 10% from June high

Although Bitcoin and Ethereum are currently down by 15% from their annual peaks, other major cryptocurrencies like Solana (SOL) and Avalanche (AVAX) have witnessed drops ranging from 40% to 50% from their highs in March.

Challengers at the Layer 1 level, such as SUI and APT, have dropped significantly by 60% to 70%. This downward trend is worsened by selling pressure from venture capital funds, increased unlocks, and stagnant inflows of seasonal market patterns.

Market analysis and on-chain metrics signal bearish trends for SHIB

In the past 24 hours, the price of SHIB experienced a substantial decline as sellers vigorously defended any attempt to breach resistance levels. Coinglass data reveals that liquidations for SHIB totaled over $360,000, with buyers liquidating approximately $308,000 worth of long positions.

This downturn is underscored by several bearish on-chain indicators, suggesting potential further declines in SHIB’s price. Both trading volume and open interest for Shiba Inu dropped by 16% and 2%, respectively, significantly reducing volatility.

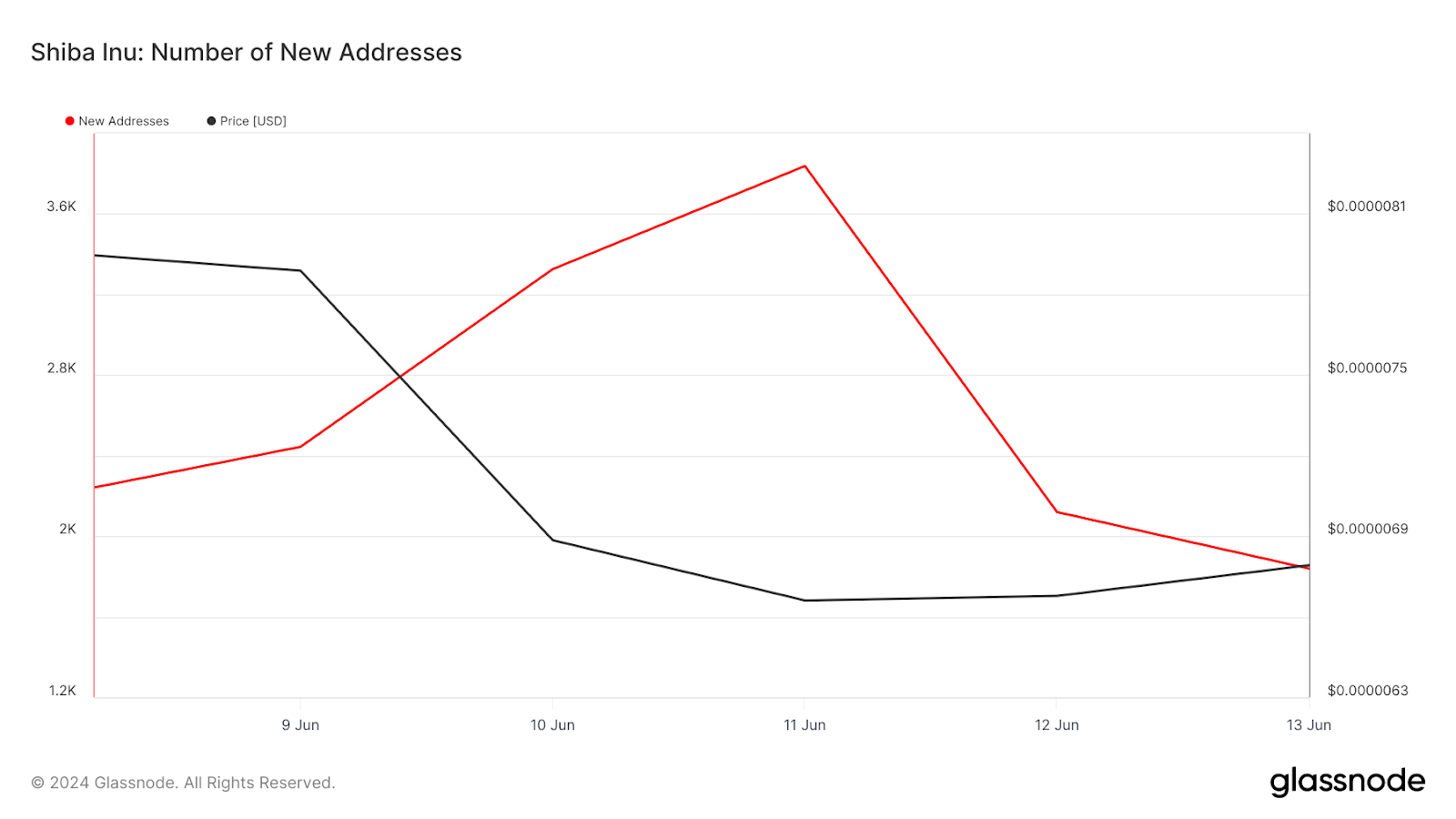

Moreover, SHIB’s network activity has sharply decreased recently, with active addresses falling from a peak of 4,600 to 3,200 this week after failing to break through resistance. This decline indicates reduced user engagement, contributing to lower trading volumes and strengthening bearish sentiment.

Source: Glassnode

Source: Glassnode

Simultaneously, the creation of new addresses declined from 1,330 to 1,140, signaling decreased demand for SHIB this week and triggering a pronounced bearish retreat in its price.

Shibburn data highlights a notable 260% increase in Shiba Inu’s burn rate over the last day, removing 29,956,875 SHIB tokens from circulation. This surge in burning activity has drawn attention in the memecoin market. Token burns are a deliberate strategy to decrease a coin’s total supply, potentially increasing prices by increasing scarcity.

Crypto tokens dilution concern

The issue of token dilution is significant among altcoins, where ongoing token unlocks, and distributions continue to increase token supplies. For instance, Arbitrum’s token (ARB) has seen its price nearing its all-time low despite rising market capitalization due to expanded supply. Solana, too, faces daily inflation of 75,000 tokens valued at approximately $10 million at current prices.

Also Read: Meme coins volatility peaks as US presidential debate looms

Unlike traditional markets with steady passive investments from ETFs and bond buybacks, cryptocurrencies, especially altcoins, experience constant sell pressure. Having invested heavily during Q1 2022, venture capital funds are now under pressure to deliver returns amidst a challenging market environment exacerbated by declining liquidity inflows.

Sell pressures and seasonal trends impacting crypto markets

The market’s appetite for speculative crypto assets has waned recently, evidenced by decreasing trading volumes and stablecoin balances on exchanges, which are essential for market liquidity. This trend poses a significant challenge for tokens expecting upcoming unlocks and launching new token issuance programs.

Seasonal trends also play a role, with June historically being a challenging month for altcoins. Recent data shows a consistent decline in the aggregated crypto market cap, excluding BTC and ETH, during June over the past six years, with this June showing an 11% decrease in the TOTAL.3 metric.

Source: TradingView

Source: TradingView

While Bitcoin and Ethereum stabilize close to their highs, the broader crypto market faces substantial challenges driven by token dilution, reduced investor demand, and seasonal downturns, disproportionately affecting smaller cryptocurrencies.

Cryptopolitan reporting by Florence Muchai