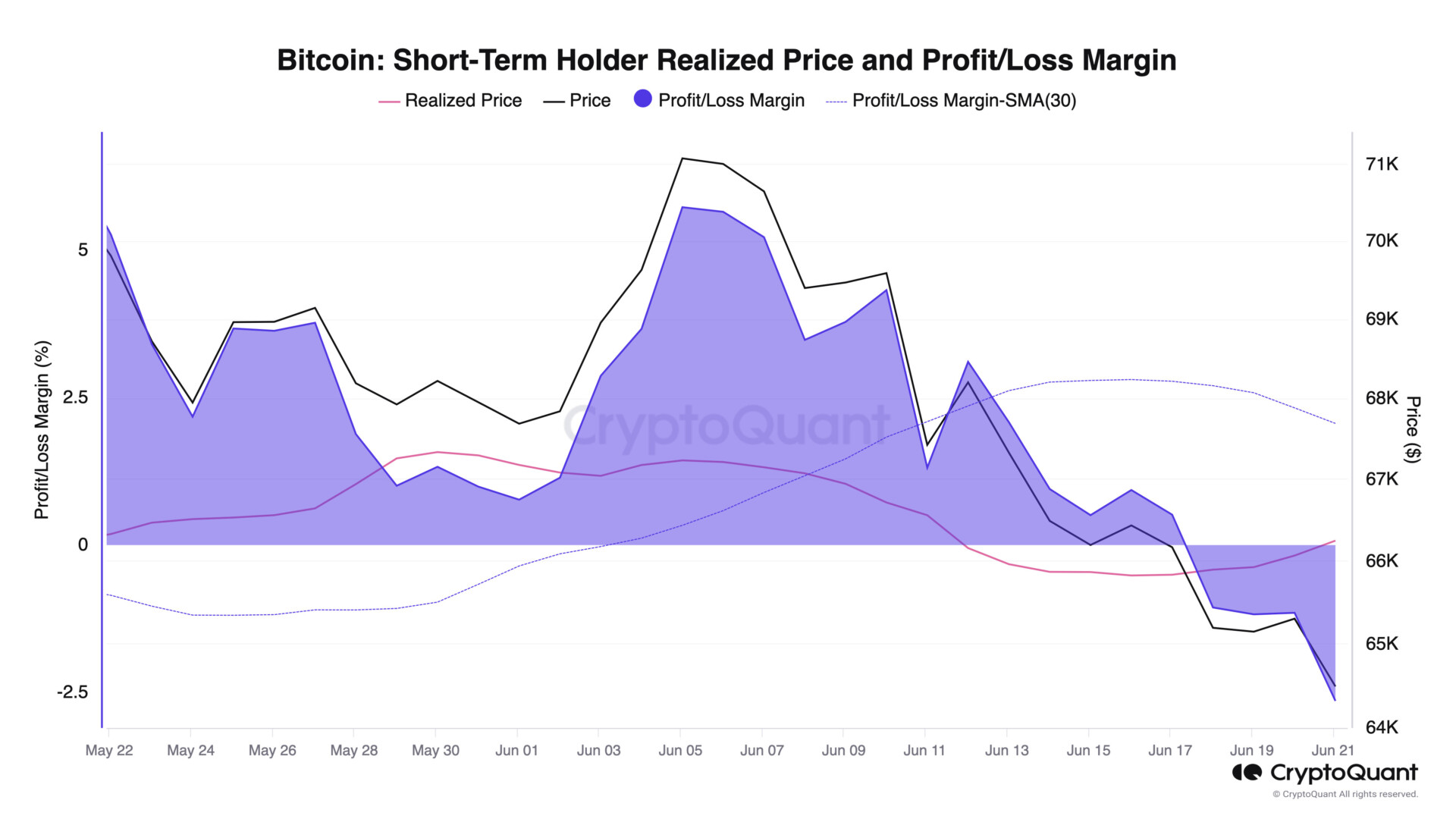

Bitcoin (BTC) is on the edge of a potential plunge to $60,000 as traders continue to abandon the cryptocurrency. With its price currently at $64,000, it sits dangerously near the critical level of $65,800.

This on-chain realized price could act as a support level, but if breached, it will signal an 8%-12% correction, driving the price down to $60,000, according to CryptoQuant.

Source: CryptoQuant

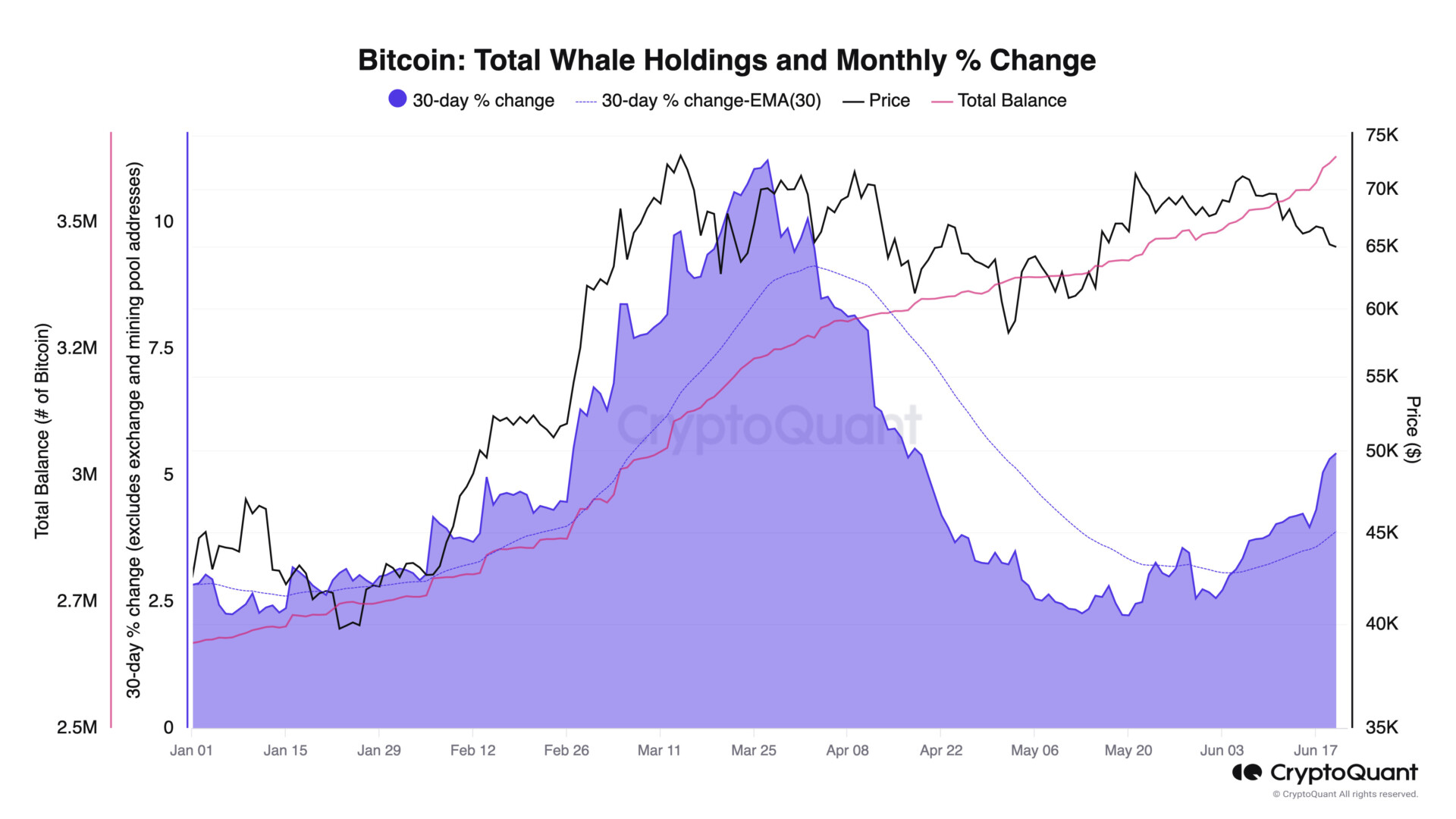

Source: CryptoQuant

Demand indicators show weakness

Despite Bitcoin’s high trading range, demand indicators are showing significant weakness. Traders are not increasing their Bitcoin holdings, and the whales are not showing the demand growth necessary to boost prices.

Whale holdings are only growing at a monthly rate of 4.8%, contrasting to the 6%- 10% monthly growth seen during the Q1 rally that pushed Bitcoin to record highs. This lack of enthusiasm from big players is a worrying sign for the market.

Adding to the bearish sentiment, stablecoin liquidity has slowed down considerably. The growth in Tether’s (USDT) market capitalization, a key indicator of liquidity, has dropped from $12.6 billion in late April to just $3.7 billion currently.

This is the slowest growth pace since November 2023. As CryptoQuant’s report pointed out , without sufficient stablecoin liquidity, Bitcoin prices struggle to rally.

The demand from US investors, which played an important role during the early 2024 frenzy, has yet to come back for both Bitcoin and Ether.

This is evident from the Coinbase Premium Index, which has remained below zero since May 20. The absence of strong US investor demand contributes to the lack of upward momentum in Bitcoin’s price.

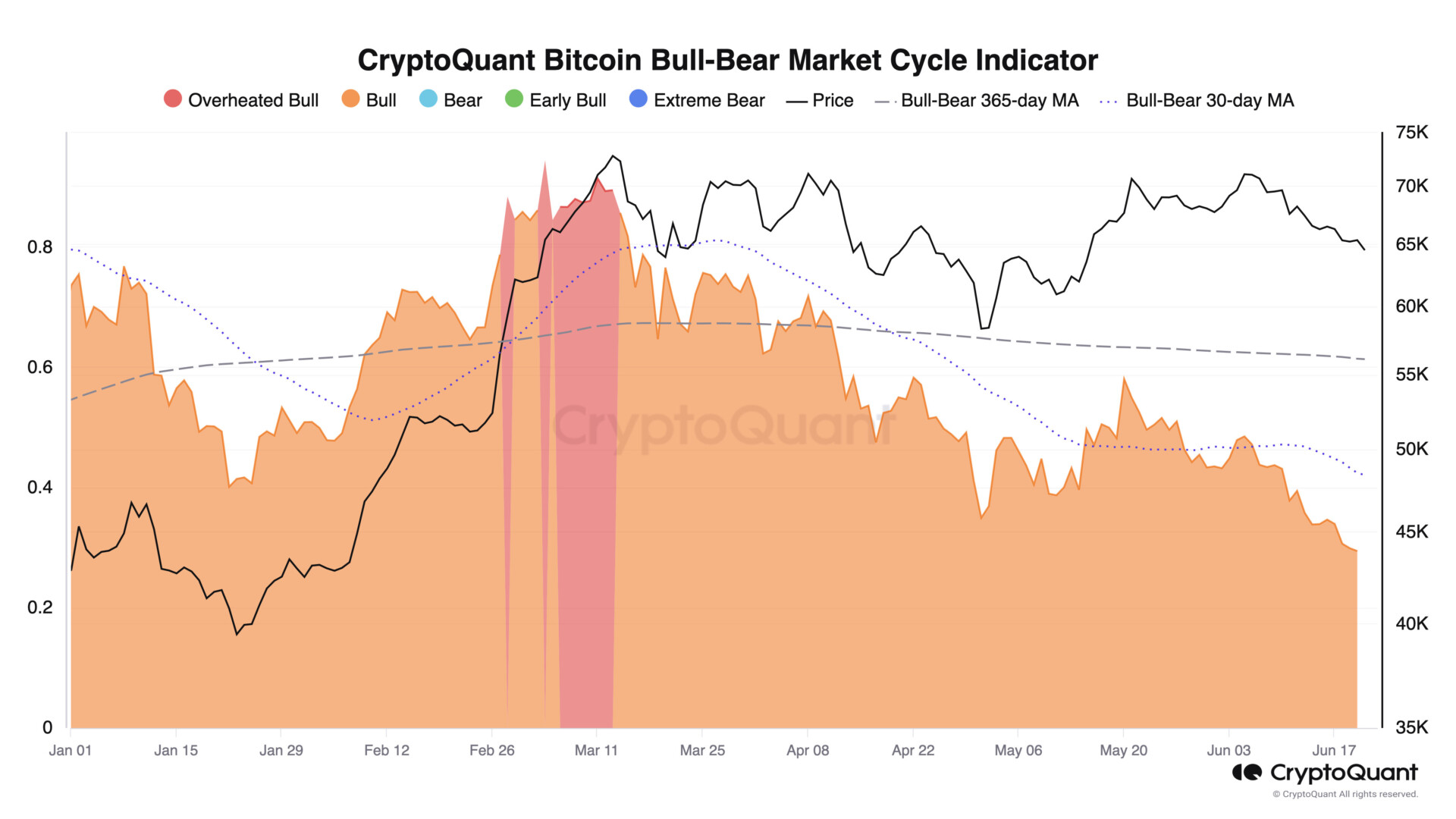

But here’s the twist. Despite it all, CryptoQuant’s Bull-Bear Market Cycle indicator says we are still very much in a bull market, albeit one without much upward momentum. The indicator is at its lowest level since October 2023 and is below its 30-day moving average.

For the market to regain its bullish momentum, this indicator would need to cross above its 30-day moving average. Until then, the general outlook from CQ analysts remains bleak, with limited upside potential for the market in the short term.

Bitcoin was worth $64,027 at the time this article was published.

Cryptopolitan reporting by Jai Hamid