Arthur Hayes has once again released a thought-provoking essay on the impact of US monetary policies on Japanese banks. He predicts that these banks will soon sell off large amounts of foreign bonds, mainly US Treasuries (USTs).

He believes this will prompt the Bank of Japan (BOJ) to use the Federal Reserve’s FIMA repo facility. The increase in dollar liquidity could greatly benefit Bitcoin and other cryptocurrencies.

Source: X.com

Source: X.com

Arthur calls his essay “Shikata ga nai,” meaning “it cannot be helped.” This is apt for Japanese banks caught in a tough situation due to US monetary policies. These banks engaged in a dollar-yen carry trade to earn higher yields. They borrowed yen from local savers, seeing near-zero yields on domestic bonds, and instead invested in USTs, which offered better returns even when hedged against currency risk.

Related: Arthur Hayes: Bitcoin slump will trigger a financial crisis

But inflation hit the US hard due to stimulus payments and lockdown measures during the COVID-19 pandemic. The US Federal Reserve responded by raising interest rates at the fastest pace since the 1980s. This was disastrous for UST holders, leading to the worst bond market since the War of 1812.

The initial banking casualties emerged in the US in March 2023, with three major banks failing in less than two weeks. This led to a bailout for all USTs held by US banks, causing Bitcoin to surge by over 200%.

The role of the FIMA repo facility

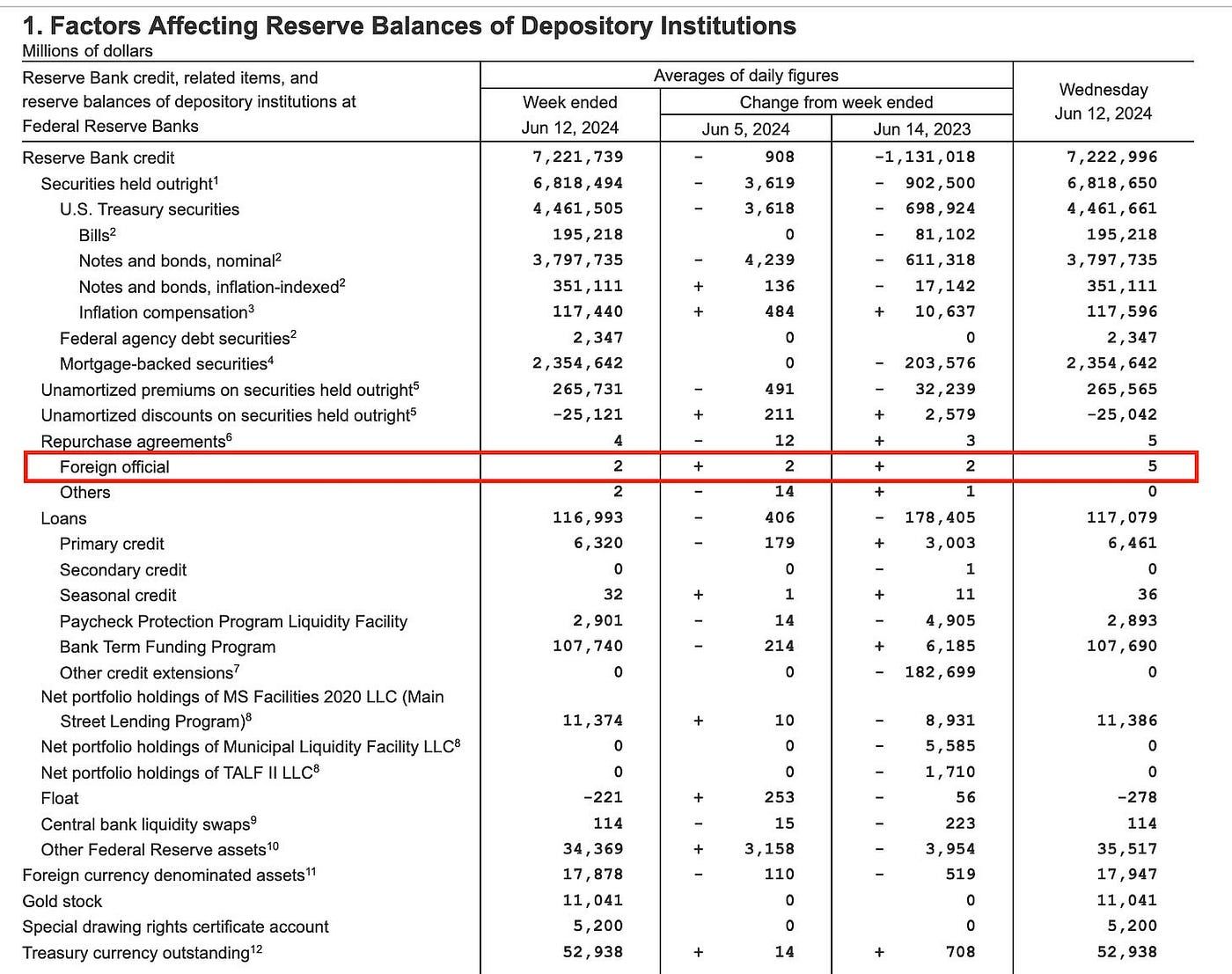

The FIMA repo facility, established in March 2020, lets central banks pledge USTs for overnight dollar liquidity. Arthur explains that increasing FIMA repo activity means more dollar liquidity in global markets. This stealthy money printing benefits Bitcoin and other cryptos. Arthur learned about this mechanism from an Atlanta Fed report, understanding how it can keep USTs off public markets.

Factors Affecting Reserve Balances as of June 12, 2024. Credits: Arthur Hayes

Factors Affecting Reserve Balances as of June 12, 2024. Credits: Arthur Hayes

The BOJ can use the FIMA repo facility to help Japanese banks avoid market losses. By buying USTs directly from banks, the BOJ can manage the USD interest rate risk without going bankrupt. The BOJ, a quasi-government entity, doesn’t face the same capital adequacy or risk management constraints as commercial banks. The FIMA repo facility allows the BOJ to roll repos daily, holding USTs until maturity.

Arthur believes Yellen will support the FIMA repo facility to prevent a spike in UST yields, which would hurt the US economy. The facility was created during the March 2020 “dash for cash,” allowing central banks to raise cash without selling USTs outright. This helped stabilize the Treasury market.

Related: Arthur Hayes says it’s time to go long on Bitcoin

Arthur plans to increase his crypto investments, anticipating more dollar liquidity from Japanese banks selling USTs. This liquidity is essential for the current dollar-based financial system. The BitMEX founder advises buying the dip in Bitcoin and other cryptos, as increased dollar supply supports the market.

He said , “This is just another pillar of the crypto bull market. The supply of dollars must increase to maintain the current Pax Americana dollar-based filthy financial system. Say it with me, ‘Shikata Ga Nai,’ and buy the f***ing dip!”