- WLFI rallied following a $10M buyback, breaking out of a tightening price pattern.

- Volume surged with fresh long positions, but overbought signals hint at a possible short-term pause.

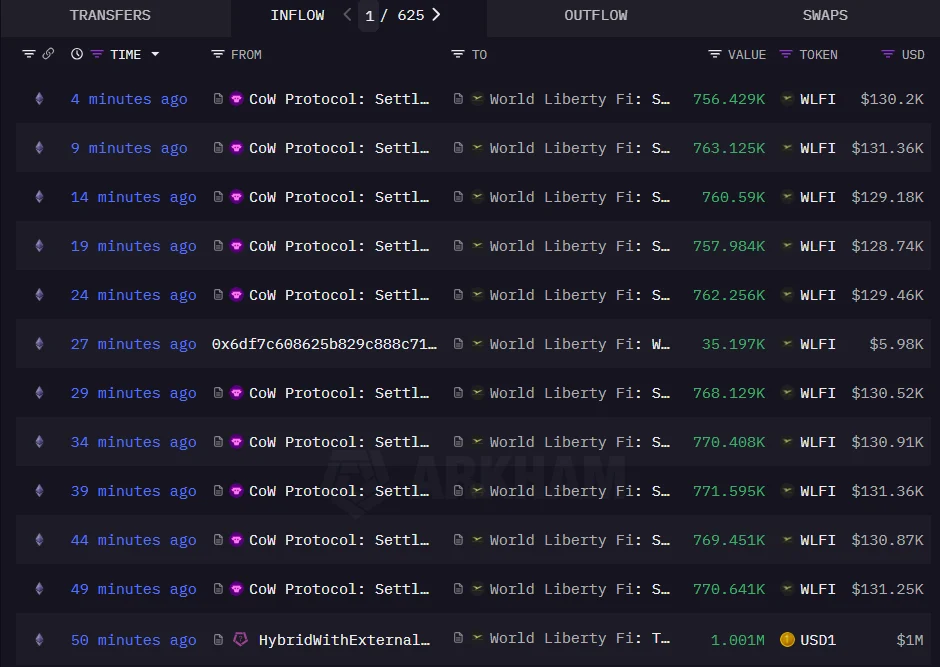

World Liberty Financial has completed a $10 million token buyback within six hours. Data from Arkham Intelligence reported the repurchase involved 59 million WLFI tokens, executed through the decentralized platform CoW Swap.

Founded in 2024, the project centers on providing blockchain-based financial services through its WLFI token and USD1 stablecoin. It promotes development aligned with U.S. financial principles, emphasizing compliance and dollar-based digital products.

Following the buyback, WLFI saw a noticeable jump in price, increasing 8% over the past 24 hours. The token is priced at $0.171, pushing it near the top of its recent weekly range of $0.117 to $0.170. Over the week, WLFI has risen about 20%, while the past month has seen a 15% gain.

Source: Arkham Intelligence

Source: Arkham Intelligence

Rising interest fuels WLFI breakout

Trading activity picked up significantly in the hours following the buyback. Daily volume surged to $320 million, up 26%, reflecting stronger interest from traders who had been quiet in recent sessions. On the derivatives side, futures volume increased 24% to $582 million, and open interest grew by 14%.

This kind of open interest growth during a rising price trend typically points to new long positions entering the market, rather than traders simply closing shorts. That momentum helped reinforce the upward movement of WLFI.

Chart analysis shows that WLFI formed a symmetrical triangle between October and early November. Lower highs and higher lows converged to create pressure at the pattern’s apex. Price finally broke out in a strong series of green candles, signaling renewed interest and increasing volume.

Source: TradingView

Source: TradingView

Technical Indicators Back the Uptrend

WLFI has now moved past two key moving averages — EMA20 and EMA50 — reclaiming $0.1439 and $0.1524, respectively. This shift above both averages is usually seen as a confirmation of strength in the near term.

Technical indicators like the relative strength index (RSI) stand at 63, reflecting growing interest from buyers without reaching an overheated level. The Directional Movement Index also showed a bullish crossover, reinforcing momentum strength.

However, early signs of overheating are also emerging. The stochastic RSI is near extreme levels, and the Williams indicator has also entered the overbought zone, suggesting a short pause in the near term.

If WLFI price remains above the support level of $0.16, the token could rise toward $0.20. This scenario depends on continued buying activity and strong volume. The recent buyback has been central to this shift, showing intent to support the price in a visible way.

Falling back below the breakout zone could weaken this setup. The $0.14 level is now being watched closely by traders, as it served as support through late October.