Nebius Group N.V. (NBIS) Stock Dips as Q3 Net Loss Widens Amid $3 Billion Meta Deal

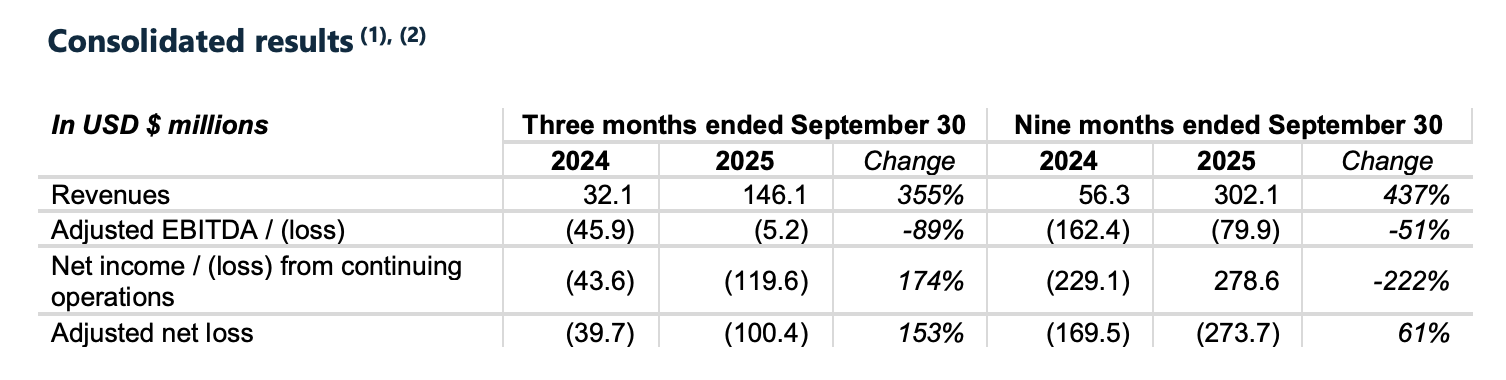

Nebius Group N.V. (NASDAQ: NBIS), a fast-growing provider of AI-focused cloud infrastructure, reported its third-quarter earnings this week with a mix of headline-making growth and deeper financial losses. The company posted a staggering 355% year-over-year revenue increase, bringing in $146.1 million for Q3 2025. Yet alongside that growth came a significantly widened net loss of $119.6 million, raising questions about the sustainability of its rapid expansion.

Adding to the spotlight, Nebius announced a new five-year, $3 billion partnership with Meta Platforms to deliver specialized AI infrastructure—its second major hyperscale deal after a $19.4 billion agreement with Microsoft earlier this year. Despite the momentum, investors weren’t convinced: NBIS stock fell roughly 7% on Nov. 11, closing at $102.22, as markets reacted to the ballooning costs and new equity issuance.

Q3 2025 Earnings Snapshot

Nebius Q3 2025 Financial Highlights

Nebius delivered one of the most aggressive growth quarters in the AI infrastructure space, with revenue surging to $146.1 million—up 355% from the same quarter last year. That figure, however, came in just shy of analyst estimates, which had anticipated closer to $155 million in sales.

The flip side of that explosive growth was a steepening loss profile. The company reported a GAAP net loss of $119.6 million, nearly triple the $43.6 million loss from Q3 2024. On an adjusted basis, the net loss stood at $100.4 million, reflecting continued cost pressures as the company accelerates its data center buildout and GPU deployments.

Capital expenditures soared to $955.5 million during the quarter, up from $172.1 million a year earlier, signaling the scale of Nebius’s infrastructure ambitions. This level of capex—more than six times last year’s spend—underscores how aggressively the company is investing to meet surging AI infrastructure demand.

Despite the growth, the widening losses and high burn rate left investors questioning when, or if, profitability could catch up.

The $3 Billion Meta Deal Explained

At the center of Nebius’s recent momentum is a blockbuster five-year deal with Meta Platforms, valued at approximately $3 billion. Under the agreement , Nebius will provide dedicated AI infrastructure—essentially custom-built data center capacity and GPU clusters—to power Meta’s expanding artificial intelligence workloads.

The Meta deal marks Nebius’s second high-profile hyperscale partnership in just three months. In September, the company signed a $19.4 billion agreement with Microsoft, further solidifying its position in the AI infrastructure race. Combined, these two anchor contracts validate Nebius’s strategy of focusing on enterprise-scale customers with massive AI compute needs.

What’s notable is that Nebius is currently capacity-constrained. The company has already “sold out” its available infrastructure, meaning it will need to rapidly deploy new hardware and facilities to fulfill the Meta contract. Management said additional capacity will be ramped up over the next three months to meet the initial delivery targets.

CEO Arkady Volozh emphasized that demand continues to outstrip supply, and the company is racing to scale. These long-term contracts help provide visibility and funding for the infrastructure Nebius needs to build—potentially laying the groundwork for its targeted $7–9 billion annual revenue run rate by the end of 2026.

Why the Stock Fell Despite Big News

Nebius Group N.V. (NASDAQ: NBIS) Price

Source: Yahoo Finance

While the $3 billion Meta deal made headlines, Nebius shares failed to rally. In fact, the stock dropped roughly 7% on November 11, closing at $102.22. That retreat reflects a broader investor concern: the scale of Nebius’s losses and the cost of its aggressive expansion.

The headline numbers—$119.6 million in GAAP net loss and nearly $1 billion in capital expenditures—overshadowed even the meteoric revenue growth. Analysts had expected a net loss closer to $97 million, so the earnings miss, paired with cash burn, raised red flags.

Adding to the pressure, Nebius announced an at-the-market equity offering to issue up to 25 million Class A shares. While the offering is aimed at raising capital for further data center expansion, it also signals shareholder dilution—something markets tend to penalize, particularly in high-growth but unprofitable tech names.

Investor sentiment reflected a broader skepticism toward growth-at-any-cost models. Despite securing a marquee customer in Meta, the lack of short-term profitability and rising financing needs led many to take a more cautious stance on NBIS, at least for now.

Strategic Outlook & Future Risks

Nebius has made it clear that its ambition is nothing short of becoming a foundational pillar of the global AI infrastructure ecosystem. The company currently operates around 220 megawatts of AI compute capacity, but it aims to scale that to as much as 1,000 megawatts by the end of 2026. Even more aggressively, Nebius now targets 2.5 gigawatts of contracted capacity—more than 10x its current scale—within that same timeframe.

To achieve this, Nebius is deploying capital at a blistering pace. Management acknowledged that the company will require significant external financing to stay on track. During the earnings call, CFO Dado Alonso indicated that options on the table include asset-backed loans, corporate-level debt, and further equity issuance. While this financing is critical for growth, it also introduces balance sheet risk and potential shareholder dilution.

The good news: demand is robust. Nebius has already sold out its current capacity, and the Microsoft and Meta deals are structured with staggered deployment based on Nebius’s ability to deliver. This backlog gives the company a rare level of visibility in a sector where most players are still competing for enterprise traction.

But execution risk looms large. Building and operating hyperscale AI infrastructure is capital-intensive, logistically complex, and time-sensitive. Any hiccup in supply chain, construction, or financing could disrupt the growth trajectory. Moreover, Nebius must contend with deep-pocketed rivals like Amazon, Google, and emerging infrastructure startups—all eager to claim a share of the AI gold rush.

What’s Next After Q3? Analyst Forecasts for Nebius Group (NBIS)

Despite the post-earnings dip, Wall Street remains cautiously optimistic on Nebius. As of mid-November 2025, the stock holds a consensus rating of “Strong Buy”, with analysts pointing to its unmatched growth trajectory and long-term revenue potential from the Meta and Microsoft deals. The average price target sits around $105 to $106, implying modest upside from current levels near $102.

Several analysts praised Nebius’s ability to land blue-chip customers so early in its growth curve. The partnerships with Meta and Microsoft offer both credibility and scale—key pillars for investors betting on the future of AI infrastructure. Some even suggest that Nebius may be ahead of better-known players like CoreWeave and Lambda Labs in terms of execution and forward visibility.

That said, there’s no shortage of caveats. Analysts widely acknowledge the risk of overextension, noting that Nebius’s aggressive capex and financing needs leave little room for error. Execution—on both infrastructure delivery and financial discipline—will be watched closely.

Additionally, some believe the market has already priced in a “best-case” scenario, given NBIS stock’s ~260% year-to-date gain before earnings. To maintain its valuation, Nebius will need to keep winning contracts, ramping delivery, and—eventually—narrowing its losses.

Conclusion

Nebius Group’s third-quarter performance highlights both the immense opportunity and mounting pressure in the race to power the AI economy. With explosive revenue growth and multi-billion-dollar contracts from Meta and Microsoft, the company is clearly staking its claim as a major force in cloud infrastructure. But the steep losses, massive capital spending, and need for external financing show that scaling up in this space comes with real financial strain.

Investors reacted cautiously, not because they doubt demand—but because they’re watching the cost of meeting it. In a market that has grown more discerning about profitability, even AI-fueled growth stories like Nebius face scrutiny when red ink deepens.

Looking ahead, the roadmap is clear: deliver capacity, execute contracts, and manage the balance sheet with discipline. If Nebius can stay on that path, it could emerge as one of the few long-term winners in the AI infrastructure boom. For now, it remains a high-risk, high-reward bet—one that’s captivating both Wall Street and Silicon Valley.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.