AMD Stock Forecast: AI Chip Strategy, Q3 Earnings Review

AMD stock has attracted significant investor interest in recent years as the company moves to solidify its position within the global semiconductor industry. Known for its advancements in both computing and graphics processing technologies, Advanced Micro Devices (AMD) faces both opportunities and challenges as market demand for artificial intelligence (AI) chips and data center solutions grows at an unprecedented pace. The recently released Q3 2025 earnings report has drawn industry-wide attention—not only for its headline figures but also the market’s tepid reaction. This article offers a thorough analysis of AMD’s Q3 performance, the factors behind investor dissatisfaction, its business strategies for Q4, and the stock’s future prospects for 2025 and beyond.

How Did AMD Perform Financially in Q3 2025?

For the third quarter of 2025, AMD reported revenue of $5.8 billion, representing a 4% increase from the same quarter last year and an 8% rise from the previous quarter. Gross margins remained consistent at 51%. The company announced a GAAP net income of $299 million and a non-GAAP net income of $1.07 billion. Diluted earnings per share were $0.70 on an adjusted basis, which was slightly ahead of analyst expectations.

AMD’s client segment, notably its PC processors, provided most of the positive momentum this quarter. However, the company’s data center segment saw mixed results. Revenue from data centers climbed to $1.61 billion, marking a 21% year-over-year increase. Despite this growth, AMD’s gains in this area were dwarfed by rival NVIDIA, whose data center business expanded even more rapidly during the same period.

Why Weren’t Investors Satisfied With the Q3 Report?

Despite making progress, AMD’s Q3 report for 2025 failed to fully satisfy investors who are closely watching AMD stock for signs of competitive traction in the AI hardware space.

A principal concern centers on AMD's relatively slow pace of capturing market share in AI accelerators. Revenue from the MI300 series AI chips now accounts for almost a third of AMD’s data center segment, but the total remains a fraction of NVIDIA’s volume. NVIDIA posted data center revenues over $14 billion during the same quarter with a year-over-year growth exceeding 170%, while AMD’s gains were more modest.

AMD's struggles in AI hardware have been compounded by challenges in China, where ongoing U.S. export restrictions on advanced semiconductors have limited sales of high-end Instinct GPUs. Company management, led by CEO Lisa Su, acknowledged these headwinds and signaled that significant AI chip revenue growth is now expected toward the second half of 2026.

Furthermore, server CPU demand also remained softer than expected as corporate clients adjust budgets amid broader economic uncertainty and continue inventory corrections, further stalling momentum for AMD stock in the short term.

What’s Next for AMD? 2025 and 2026 Business Roadmap

Looking ahead to Q4 and beyond, AMD is sharpening its business strategy to restore investor confidence and drive the future value of AMD stock. The company is prioritizing two key areas: AI accelerators and the data center market.

Pursuing Double-Digit AI Chip Market Share

AMD aims to achieve double-digit market share (over 10%) in AI data center chips by increasing the availability and adoption of its Instinct MI300 series and introducing the MI400 series next year. The MI400 is specifically designed to compete with NVIDIA’s leading products and drive wider adoption among hyperscalers and enterprise customers.

Strategic Partnerships

A major catalyst for future AMD stock performance is a new multi-year agreement with OpenAI. According to this deal, AMD will become a significant AI chip supplier to OpenAI, a move that could generate up to $10 billion in annual revenue. Additionally, OpenAI has an option to acquire up to a 10% stake in AMD if certain milestones and stock price targets are met. This illustrates the potential for robust future revenue streams and highlights AMD’s strengthening position as an alternative AI hardware provider.

Geopolitical Risk Mitigation

With ongoing U.S. export restrictions impacting high-end chip sales to China, AMD is adjusting its global sales strategies and working to diversify its market exposure, potentially stabilizing AMD stock performance through better risk management.

What Are AMD's Financial and Stock Market Prospects for Q4 and Beyond?

For the fourth quarter of 2025, AMD has issued guidance for around $6.1 billion in revenue, which would mark a 9% increase from the previous year and exceed most analysts' forecasts. The company expects the biggest revenue lift from AI data center products and the growing adoption of new server technologies.

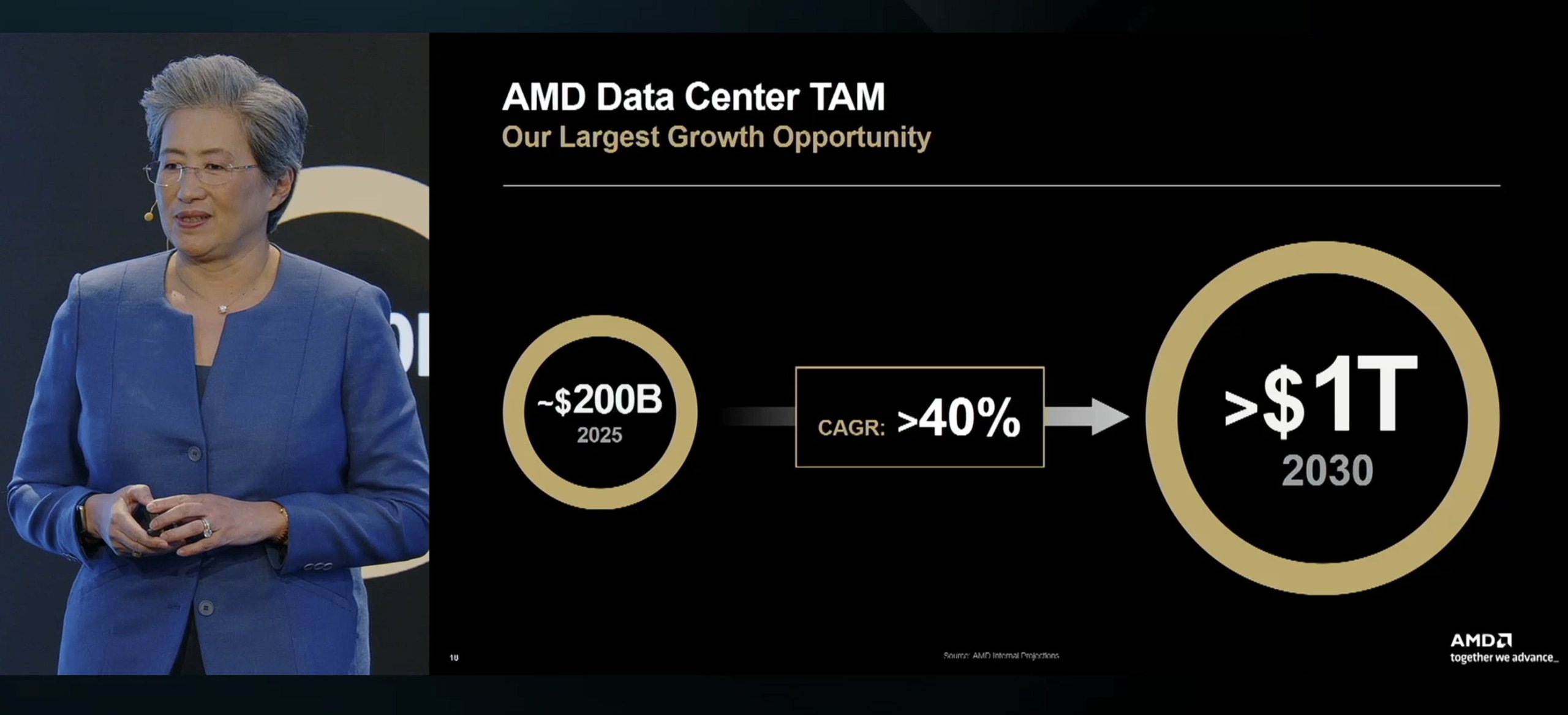

Looking even further ahead, AMD’s management projects a 60% compound annual growth rate for its data center segment over the next three to five years. The company anticipates its total revenue could triple by 2030 if these strategic initiatives succeed, which would have a major positive impact on AMD stock.

AMD Stock Price: Current Levels and Future Potential

AMD stock is trading in the $120-$130 range as of November 2025. After the Q3 2025 earnings release, AMD stock saw a single-day decline of around 4%, signaling ongoing market caution over the pace of AI chip sales and data center segment growth. Still, AMD stock is up over 70% since the start of the year, broadly in line with the continued rally across the semiconductor sector. Daily price volatility in AMD stock is being heavily influenced by quarterly performance and updates on AI-related partnerships.

The outlook for AMD stock through 2025 and 2026 remains cautiously optimistic:

-

AI and Data Center Growth: If AMD can scale up sales of the MI300 and MI400 series and secure more strategic partnerships like the one with OpenAI, it has the potential to narrow the gap with NVIDIA and drive strong growth in AMD stock.

-

Aggressive Financial Targets: Management’s projections for a 60% annual growth rate in data center revenue and a threefold rise in company-wide revenue by 2030 underline the high expectations for AMD stock, although execution risk remains.

-

Competitive Landscape: NVIDIA currently leads the field in AI GPUs and supporting software. AMD’s ability to deliver innovation and capture share in this key segment will influence its long-term stock value.

-

Macro and Regulatory Factors: Long-term AMD stock returns may also be shaped by global trade policies, economic trends, and the effectiveness of AMD’s strategy to handle U.S.–China semiconductor tensions.

Conclusion

AMD stock continues to be a focal point in the technology investment landscape. While the company’s Q3 2025 earnings underline steady progress, especially in client processors, its AI and data center segments are being watched closely by investors for evidence of stronger growth. AMD’s Q4 strategy, including pursuing double-digit AI chip market share, launching the MI400 accelerator, and deepening ties with AI leaders like OpenAI, will all be critical for shaping the future trajectory of AMD stock. With competitive pressures high and macroeconomic risks present, the next few quarters will be vital for investors considering AMD stock for their portfolios.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.